freemexy's blog

Alex Ong has been trading the financial markets for nearly 15 years and in this time, he has encountered and prospered in every type of event, economic cycle, central bank intervention or natural disaster you can think of. Alex is a seasoned professional with a wealth of trading and investment experience. Born into an affluent family with roots in the financial markets it is of little surprise that he has had so much success. As the Managing Director of a private investor fund he successfully steer the fund and its investors through the Great Recession of 2007 – 2009 and today spends his time trading his own book and teaching others to make money trading the markets. A technical analyst at heart, the majority of Alexs trading centres around chart analysis. He is of the opinion that for the most part trading opportunities can be found within the price and as long as you have a solid strategy and a calm head anyone can be successful trading Forex.To get more news about WikiFX, you can visit wikifx news official website.

WikiFX

App is a third-party inquiry platform for company profiles.WikiFX has

collected 17001 forex brokers and 30 regulators and recovered over

300,000,000.00 USD of the victims.

It, possessed by Wiki Co.,

LIMITED that was established in Hong Kong Special Administrative Region

of China, mainly provides basic information inquiry, regulatory license

inquiry, credit evaluation for the listed brokers, platform

identification and other services. At the same time, Wiki has set up

affiliated branches or offices in Hong Kong, Australia, Indonesia,

Vietnam, Thailand and Cyprus and has promoted WikiFX to global users in

more than 14 different languages, offering them an opportunity to fully

appreciate and enjoy the convenience Chinese Internet technology brings.

WikiFXs social media account as below:

Recently, WikiFX has received a complaint against FXTM in Nigeria. As per WikiFXs investigation, there is someone who pretended to be a staff from FXTM, running bitcoin business to defraud investors.To get more news about WikiFX, you can visit wikifx news official website.

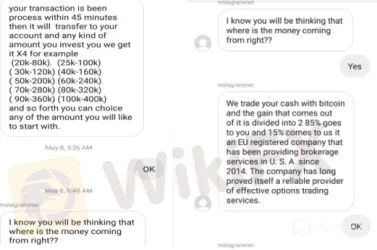

An investor said he met Mrs Aisha on Instagram, who claimed she was an agent working at Nigerian capital FXTM trading. And the investor was told that a investment model could help him gain high profits by investing bitcoin within 45 minutes. Then, the investor invested 10,000 naira bitcoins and waited to get the 40k profits. However, he did not get the money that the agent promised after 45 minutes and even was asked to invest more if he wanted to take his money back. Finally, he invested a total of 135,000 naira through the bitcoin link given by Mrs Aisha. After that Mrs Aisha disappeared.

Through the following transaction records, it can be seen that the money was transferred to three different bank accounts, which are not FXTM‘s official transaction accounts. Before, the investor also got a person’s contact information from Mrs Aisha. The person said he was Forextimes CEO, named ALONIPEKUN EBENEZER. When the investor asked the CEO how he could withdraw the money, the CEO replied that he needed to add extra 20,000 naira as his amount was not enough to carry out the withdrawal. The CEO also provided a license of FXTM regulated by the Commission Financial.

In the end, the investor found that it was actually a hoax. The FXTM was never regulated by the Commission Financial. It is worth saying that the FXTM never runs cryptocurrency businesses such as BTC. After official confirmation, they just provides trading services like Forex, Spot Metals, CFDs etc.

All in all, the fraud team pretended to be staff from FXTM and attracted more peoples attention and trust. Here are some advice which make it easy to identify scams.

1: Legal broker will not introduce you to their investment plans by the third-party social platform.

2: Legal broker has official email address and customer service and will not contacts you by WhatsApp, Instagram and Facebook.

3: Investment model with high profits is always a potential trap.

4: Download WikiFX App to check a brokers score and credit.

As a famous forex broker in the world, the FXTM can be trust and reliable. As for more information about the FXTM, such as basic information, regulatory information, MT4/5 identification, credit report etc, you can log in WikiFX official website or use WikiFX App.

Recommended by Daniel Dubrovsky

What is the road ahead for the US Dollar?

Get My Guide

Equities and the British Pound received a boost in late Asia Pacific trade when reports crossed the wires that the United Kingdom announced a new post-Brexit tariff regime. The plan would cut about GBP30 million in tariffs after the nation leaves the European Union following the 11-month transition period. This expires at the end of this year. This update reversed some weakness Sterling saw after Brexit talks recently disappointed.

Sentiment noticeably soured after Stat – a health-oriented US journalism company – criticized Moderna‘s virus drug trial study that sent markets soaring yesterday. The report said that the company withheld ’key information about its Covid-19 vaccine. It also highlighted that the study did not produce enough critical data in order to assess its success.

In the White House, President Donald Trump said today that ‘there is tremendous progress’ on a vaccine and that the country is ‘way ahead’ of schedule on cures. Meanwhile Fed Chair Jerome Powell and Treasury Secretary Steven Mnuchin testified before the Senate. The former warned that lasting unemployment could weigh on the economy for years as the latter anticipated economic improvements in the second half of 2020.

Discover your trading personality to help find forms of analyzing financial markets

Wednesdays Asia Pacific Trading Session

Asia Pacific benchmark stock indexes – such as the Nikkei 225 and ASX 200 – could follow the pessimistic mood from the Wall Street trading session. That may continue to drain some of the gains NZD/USD accumulated as of late. A deterioration in market mood may also help to alleviate some declines the Yen and US Dollar experienced.

New Zealand Dollar Technical Analysis

NZD/USD seems to have set a third lower high since prices appeared to peak in late April. Prices paused the latest bounce just under key resistance which is a range between 0.6130 – 0.6156. Prices appear to be facing immediate support at 0.6069. A turn lower from here places the focus on the 0.5989 – 0.6014 inflection range. Beyond that area sits 0.5918. Uptrend resumption through resistance exposes 0.6190.

With Cataclysm Timewalking event approaching closer, Safewow will provide cheap WOW gold and other products with 6% and 8% off from Jul. 6. Claim more cheap gold from us to enjoy Cataclysm Timewalking better. To get more news about WoW Items, you can visit lootwowgold news official website.

Time to enjoy cheap WOW gold with up to 8% off

Our promotion on the theme of Cataclysm Timewalking will hit on Jul. 6 and come to an end on Jul. 16, 2020. Once the promotion begins, you can be able to enjoy up to 8% off WOW gold at our site.

Buy cheap WOW gold & others with 6% & 8% off

Apart from WOW gold, other goods like WOW Classic gold, Neverwinter

Astral Diamond can also be purchased with 6% and 8% off during our

promotion. You can apply for one of the following discount codes to save

more:

6% Off for all code "WCT6": This 6% off code is available for all your orders.

8% Off $100+ code "WCT8": This 8% off code is available when your order is worth $100 or more.

Have fun during the upcoming Cataclysm Timewalking with cheap WOW gold. Besides, please put your orders from us at all times. The price is always reasonable for you!

For world of warcraft players, farming wow gold is no doubt a boring thing. Some players may spend hours on world of warcraft gold farming, while others spend most of their time farming. It’s obvious that the former master some gold making guides. Here safewow offer you some best farming spots in Mists of Pandaria.To get more news about Buy WoW Gold, you can visit lootwowgold news official website.

The Worth Farming Items in Mists of Pandaria

Usually players can get wow gold and items for sale by killing

creatures. While for some higher level mobs, there will be some valuable

items dropped and players can keep them for their own use, or just sell

it to make money. A good item set at 10g on a vendor, may sell to Mists

of Pandaria AH for much more gold.

Best World of Warcraft Farming Guide and Spots Get Gold Quickly

Winterspring, the Western Plaguelands, and Azshara are money making

shrines for players, namely, the best farming spots. Killing creatures

in Mists of Pandaria is a good way to make wow gold. However, the easier

the mobs to kill, the less money they brings. Just team up with others

to kill high level mobs, this will definitely bring more wow gold to you

quickly.

1. Winterspring

Here players can get loads of wow gold and amazing items by killing the mobs in the Lake of Ke’Theril as well as Cobalt Mag weavers and Scale bones in southeast of the Lake. Remember that these items are rare with a high demand in the market, what’s more, they can bring mature blue dragon sinew, which can sell for a hundred of gold.

2. Plaguelands

At Plaguelands, you can farm rotting behemoths and the mobs at Felstone Field, they are easily obtainable.

3. Azshara

This is one of the best farming place in Mists of Pandaria. Many high borne ghosts are there and they drop good items that players can sell for plenty of gold.

All in all, there are many ways to get wow gold. Just give this guide a try to see whether it is suitable for you. If not, maybe you can also get cheap world of warcraft gold quickly from online suppliers.

According to the UK's National Lottery, John and Allison McDOnald won the £2 million jackpot on December 18, one of the last lottery draws of the year.

John, a 62-year-old security officer, checked his ticket at work and initially thought he'd matched two numbers and won a lucky dip. When he realized he had matched all six numbers for the jackpot, UK National Lottery said he got the "leg trembles."The excitement didn't end there for the lucky family. Just three days later, the couple received news that their 15-year-old son Ewan was cancer free according to the BBC. Ewan had been battling Non-Hodgkin's Lymphoma and was receiving chemotherapy for the past year.

"It is just like all of our lifelong dreams came true in the space of three days," John told the BBC.

We are so thankful. 2020 is certainly looking like being one amazing year for the three of us."

According to the UK National Lottery, John and Allison are now planning for retirement. They plan on spending family time as well as traveling.

Grocery store bagger won $70M from lottery ticket bought

A 22-year-old grocery store employee just won the biggest jackpot in Quebec’s history after he purchased a ticket from the store where he works.Get more news about 彩票包网服务,you can vist loto98.com

Gregory Mathieu, a bagger at the IGA Extra in the Saint-Romuald district of Levis, Québec City, showed up to the lotto office in Québec, Canada, on Wednesday with the winning ticket, Corporate Director of Public Affairs at Loto?Québec Patrice Lavoie told CNN.

“Loto?Québec celebrates its 50th Anniversary this year,” Lavoie said. “We are thrilled to, at the same time, give our biggest jackpot yet.”

Eight others won $1 million in the same draw as Mathieu, the lottery’s website said.

The young man said he plans to share the winnings with his closest relatives. “There will be eight winners from the same family,” Lavoie said. “He shared it with seven family members.”

The lottery plans to hold a press conference on Friday to introduce the winner and have his photo taken holding a giant check. Because, is it really official if you haven’t done that?

Lavoie and other Loto?Québec officials say they will give Mathieu advice on what he should consider doing before handing over the cash. “If you like your job, you don’t need to retire yet,” Lavoie will say. “And be careful what you post on social media.”

That’s good advice for grocery store workers and lotto winners alike.

World of Warcraft Classic, AKA WoW Classic, has finally launched, rolling back the clock on 15 years of updates to the world’s most popular MMORPG to give fans a glimpse of what the game was like close to when it originally released. To get more news about WoW Classic Items Buy, you can visit lootwowgold news official website.

Long waits to get into WoW Classic servers have marred the return somewhat, but for the most part, it’s proving to be a very enjoyable stroll down memory lane.

But what’s the big deal about reviving a 15 year old version of a game that never really went away?

Well, can you imagine a world without World of Warcraft? After 15 years spent exploring the wastes, wildernesses and wonders of Azeroth, it’s hard to think of a gaming landscape without Blizzard’s all-conquering massively multiplayer RPG in it. And, with World of Warcraft Classic, we get the opportunity to experience those first fledgling days with the game, all over again, and see just why it was so influential.

In the world of online games, 15 years is an incredibly long time – it’s almost unheard of for a game to maintain a community like World of Warcraft has over that period of time, especially when it requires a subscription to play. Plus, to keep that fanbase loyal, Blizzard has added more and more to World of Warcraft over the years, piling expansion on top of update on top of expansion.

What then, if you pine for the simpler, early days of the game, when World of Warcraft was fresh, new, and a little more mysterious?

Don those rose-tinted glasses – that’s where World of Warcraft Classic comes in.

Crude Oil Price Breakout Eyed, Will the Canadian Dollar Capitulate Up?

Growth-oriented crude oil prices climbed to a 10-week high as market sentiment broadly improved over the past 24 hours. The Dow Jones and S&P 500 closed +1.52% and +1.67% respectively as my Wall Street index attempted to make upside progress after idling for the better part of the past 3 weeks. The Canadian Dollar – which can at times be sensitive to swings in crude oil – struggled to capitalize on gains in the commodity.To get more news about WikiFX, you can visit wikifx news official website.

Recommended by Daniel Dubrovsky

What is the road ahead for Crude Oil?

Get My Guide

The

upbeat tone in financial markets showed that investors shrugged off

recent doubts over the potential viability of a coronavirus vaccine in

the works from Moderna. Instead, traders may seem to be looking forward

to a gradual easing in lockdown measures that should help restart

economic growth. This may also explain why oil is now spending more time

moving in tandem with global equities as of late.

Still, challenges may be ahead. Minutes from the FOMC meeting showed that policymakers see ‘extraordinary uncertainty’ and ‘considerable risks’ in the medium term. A few Fed officials also saw a ‘substantial likelihood’ of more Covid-19 waves. Meanwhile an oversight bill sent US-listed Chinese stocks dropping as tensions between the worlds largest economies seem to be heating up.

Develop the discipline and objectivity you need to improve your approach to trading consistently

Thursdays Asia Pacific Trading Session

With that in mind, Asia Pacific equities could echo the upbeat tone from the Wall Street trading session. This could bolster crude oil prices as the Canadian Dollar pressures resistance against an average of its major peers. Rising equities may also support the sentiment-linked Australian Dollar. AUD/USD will also be eyeing commentary from RBA Governor Philip Lowe.

Crude Oil Technical Analysis

On a daily chart, WTI crude oil prices have broken above ‘outer’ resistance from the beginning of this year. Follow-through at this point is absent. Rising support from Aprils bottom is also guiding the commodity higher – blue line. This has ultimately exposed former lows from August 2016 which could stand in the way as new resistance. A turn lower places the focus on resistance-turn-support at 29.11.

Market sentiment appeared to have a risk-off tilt as the anti-risk US Dollar and Japanese Yen rose at the expense of the cycle-sensitive Australian Dollar. US equity futures pointed in the same downward direction while Asia-Pacific stocks traded mixed. RBA Governor Philip Lowe gave a speech, warning that monetary policy has its limits and that fiscal measures are crucial in combatting the coronavirus. Read the full report here.To get more news about WikiFX, you can visit wikifx news official website.

Euro Outlook Ahead of ECB Minutes

It is difficult to say how the Euro will react to the publication of ECB meeting minutes considering most of the attention now appears to be focused on the central banks tension with the German high court. It recently issued a ruling that deemed the 2015 asset purchases program and the subsequent growth of the ECB balance sheet to its current size illegal, giving the central bank three months to explain their policies.

The court said that unless such an explanation can be made, the Bundesbank will not participate in the quantitative easing program. ECB President Christine Lagarde defended the central banks decision and affirmed her support of the Pandemic Emergency Purchase Program (PEPP). This extraordinary measure by the ECB entails purchasing 750 billion euros of debt this year in order to contain the financial fallout from Covid-19.

If the underlying tone of the minutes strikes an unexpectedly gloomy tone, it could lead to heightened liquidation pressure in the Euro. Investors will be eagerly scanning the pages to find a more detailed outlook on the ECBs position for its PEPP program. In a recent interview, Mrs. Lagarde made it clear that monetary authorities “will not hesitate to adjust the size, duration and composition of the PEPP to the extent necessary”.

British Pound Braces for UK PMI Data

The British Pound may decline following the publication of flash PMI data for May. Manufacturing, services and the composite reading are expected to print at 37.2, 24.0 and 25.7 print, respectively. While this is far below the neutral 50.00 figure, it is an improvement from the prior month.

Worse-than-expected readings could inspire further rate cut bets

from the Bank of England as officials contemplate the use of negative

interest rates. Selling pressure in Sterling may also be amplified by

growing uncertainty about the outcome of Brexit. Last week, EU and UK

officials sent a chilling message about progress – or more accurately,

the lack thereof – which subsequently sank the Pound.

EUR/GBP Outlook

EUR/GBP is testing the lower tier of the key inflection range between 0.8986 and 0.9091 (purple-dotted lines) where the pair had previously encountered both upside and downside friction amid market-wide volatility in March. If EUR/GBP shies away from clearing the multi-layered ceiling, a subsequent pullback may ensue. In this scenario, selling pressure may start abating when the pair hits familiar support at 0.8687 (red-dotted line).